Ads appear atop Uber rides, between Tinder swipes, and intermixed among Waze locations. Increasingly, non-traditional publishers are launching ad platforms within their sites, apps, and DOOH offerings.

Why?

Ads, after all, have a bad reputation: many brands avoid monetizing their site/app with ads, often fearing poor user experiences and complex privacy laws.

However, non-traditional publishers (or, companies that don’t rely on ads for revenue) have what advertisers will pay premiums for: unique first-party data, engaged users, and high traffic volumes. Non-traditional publishers, therefore, are finding ads to be a highly profitable revenue stream, and, if executed well, can even enhance user experience.

In this article, we review the recent history of non-traditional publishers, expound upon why these (and others) launched ad platforms, and defend why you should launch your own today.

What is a non-traditional publisher?

A __non-traditional publisher__ is a brand with a large digital presence whose revenue is predominantly non-ad-based. They’re funded, instead, by subscriptions, commissions, purchases, etc. Examples range from retailers to fintech companies, file sharing services to SaaS products, and more.

A traditional publisher is a company who makes their money almost entirely from ads, such as media companies, free content producers, and mobile games. Since they rely on ad revenue to survive, these brands must resort to OpenRTB programmatic ads for scale, resulting in ad-heavy pages, slow loading experiences, and standard ad units. When you think “digital ad publisher,” you likely picture this.

Because non-traditional publishers don't need ad revenue to survive, they have more freedom in designing an ad platform that’s not beholden to traditional ad networks. Their ad products differ from traditional ad programs in that they can:

- Integrate native advertising units: Since non-traditional publishers don’t want to ruin the user experience, they usually incorporate ads that seamlessly fit into their site/app. This could include promoted products within organic listings, interactive ads across login pages, and sponsored recipe ingredients. By virtue of necessity, non-traditional publishers can creatively monetize with unobtrusive native ads.

- Remove ad tags: By not using a third-party ad solution, they can serve ads without using JavaScript ad tags, a move that helps with page speed, privacy, and getting around ad blockers.

- Target with first-party data: With recurring traffic, rewards programs, and interactive platforms, non-traditional publishers can gather troves of valuable first-party data, allowing them to charge advertisers premiums to reach these segments.

- Avoid off-brand ads: By monetizing with direct-sold native ads, these publishers can ensure that all ads are on-brand and aligned with company values.

- Cultivate multi-platform experiences: Non-traditional publishers have the freedom to show ads anywhere: websites, in-app, in-store signage, on top of cars, etc. This can lead to exciting and innovative cross-platform ad experiences.

What are examples of non-traditional publishers with ad platforms?

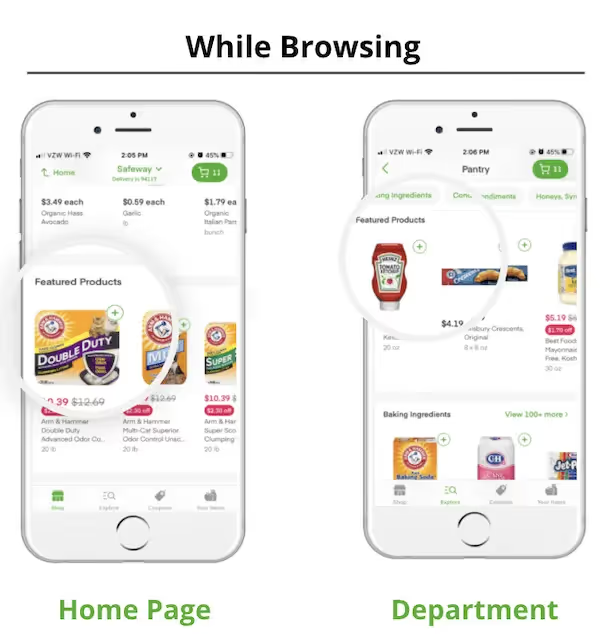

1. Instacart:

Dominating online grocery delivery, Instacart’s revenue skyrocketed during Covid. To capitalize on this increased demand, Instacart launched an ad platform for CPG brands to promote their products. This innovative retail media platform drove $300 million in 2020, and they hope to grow it to $1 billion in 2021. This is incremental revenue that Instacart can use to keep prices low and expand quickly.

2. Klarna:

Klarna is Europe’s highest-valued private fintech company and the second-highest worldwide, providing payment solutions to consumers, merchants, and retailers. To create a new revenue stream, Klarna built an ad platform, providing new capital in a non-invasive way. Their ad product includes all the hallmarks of a non-traditional ad program: native ads, first-party data targeting, curated advertisers, and more.

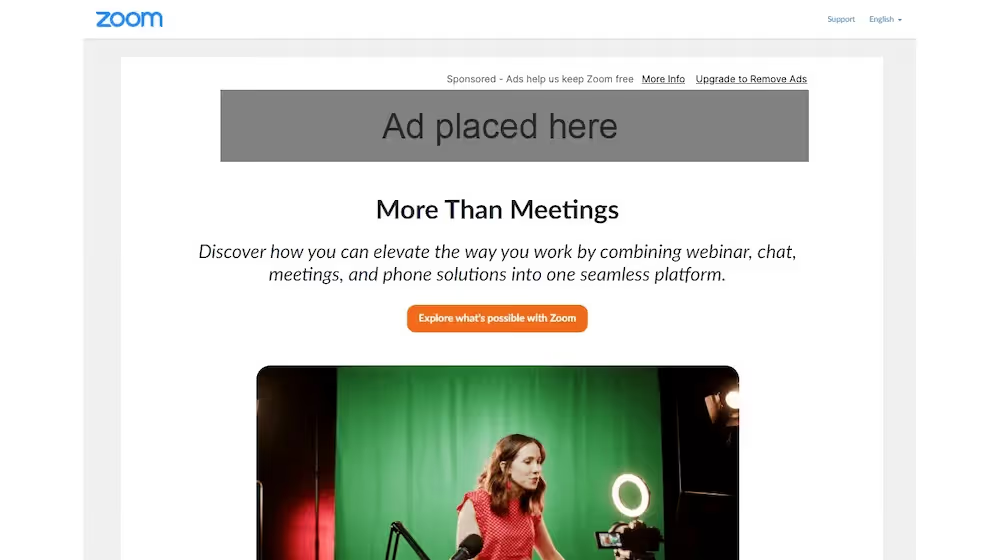

3. Zoom:

Zoom also thrived during Covid, and they recently launched a pilot ad program to display ads to free users. Zoom doesn’t need ad monetization to survive; their SaaS pricing will likely always be 90%+ of their revenue. But incremental revenue is incremental revenue, and by monetizing free users, they can now scale that side of their business cost-effectively.

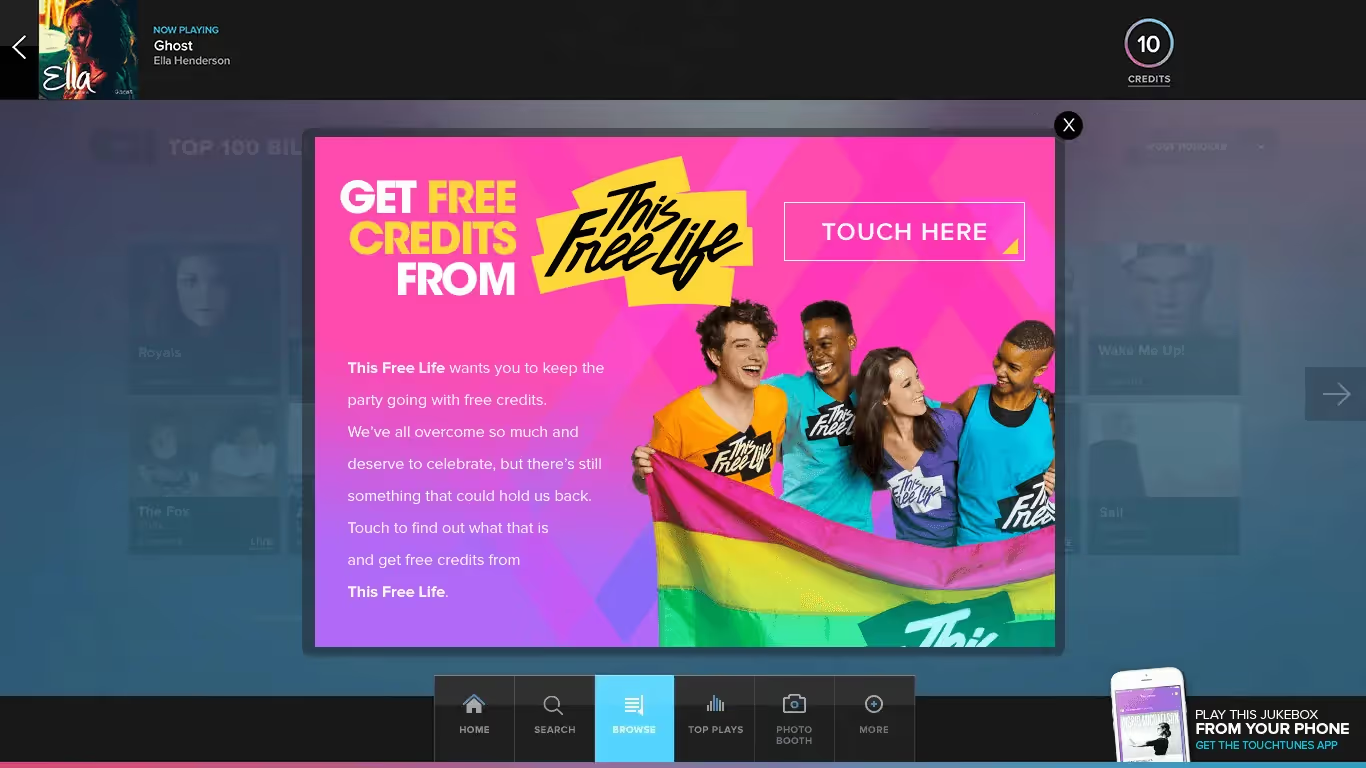

4. Touchtunes

With digital jukeboxes in over 75,000 locations, TouchTunes integrated interactive ads into their DOOH machines when people are selecting new songs to play. Touchtunes still takes in most revenue through song credits, but ads are a secondary, scalable form of revenue. And because the ads are visible and interactive, TouchTunes can charge advertisers high premiums to appear.

5. Uber

Uber is piloting their cartop advertising, allowing drivers to monetize their rooftops/interiors with ads. Though their main revenue will continue to be through ridesharing and food delivery, this ad product provides incremental revenue that they could pass onto drivers, who may become more inclined to use Uber over, say, Lyft.

So, why launch an ad platform?

Constant growth is difficult to maintain; at some point all businesses see their core revenue stream slow down or even decrease. Instacart is no exception: though they tripled revenue in 2020 over 2019, in 2021 their growth rate dropped to 10%.

Ad revenue, meanwhile, is a monetization source you can control. Even if your user base growth slows, you could find ways to maximize the value of each user through targeted ads. If that slows too, you could introduce new ad units, new auction mechanics, increase prices, find more advertisers, and so on. There's a reason that ads are Amazon's fastest growing revenue stream.

And even if you are still in high-growth mode, incremental revenue can further fuel that expansion. Take Instacart again. The $300M in ad revenue they made in 2020 was almost all profit. That’s capital that allows them to offset lower margins elsewhere. While grocery competitors may have to raise prices to stay afloat, Instacart might not have to, further ensuring they are the vendor of choice from both sides of the market.

The best part is, you don't have to sacrifice user experience for this ad revenue, either. Ad tech is evolving beyond standard banner ads and annoying pop-ups. Like the examples above, it's possible to monetize with non-invasive native ads that are seamlessly integrated into the user experience.

Non-traditional publishers need to be careful

Traditional publishers rely on standard programmatic ad networks to scale their revenue, which come with pitfalls like slow page load times, obtrusive banners, and limited advertiser controls. Non-traditional publishers, however, can’t risk this approach. If 95% of your revenue is coming from engaged users making purchases, what happens when poor ad experiences cause them to abandon the app?

Indeed, Amazon reports that just a second delay in page load times would result in a $1.6B loss in yearly sales revenue.

As such, non-traditional publishers have to approach ad monetization carefully; specifically, they need full control over who advertises, how fast the ads load, and how the promotions look/feel. The only way to do this is through building an in-house ad platform, also called a “walled garden,” rather than outsourcing that tech to an ad server or ad network.

A walled garden is an ad platform where the publisher handles all the buying, serving, tracking, and reporting. This typically includes first-party data targeting, self-serve advertiser portals, auction pricing, and more. Essentially, it’s a closed system where publishers own their entire ad program. This control is needed if you want to monetize with ads while not hurting your other revenue streams in the process.

How do you launch an in-house ad platform?

Walled gardens by necessity are built in-house — a process that can take years, cost millions of dollars, and require dozens of ad tech engineers. Even if they see the value in ad monetization, many non-traditional publishers are unwilling to make this sacrifice.

Maintaining this ad server, moreover, requires even more time and resources. Between server costs, engineering resources, certification fees, refunds for bugs, and so on, the costs involved can scale greatly over time.

Is there a faster way?

The good news is, you don’t have to build your ad product from scratch anymore. Kevel provides a suite of ad APIs that make it easy to launch your own walled garden in just weeks. You get the customization of an in-house build with the speed of a third-party solution. Many non-traditional publishers like Touchtunes, WeTransfer, and Slickdeals have used Kevel to build high-margin, scalable ad platforms. Contact us today to learn more.